EPF Interest Rate Impact on Salary 2026 Structure & Long-Term Savings

EPF Interest Rate Impact on Salary 2026 explained. Learn how EPF interest affects PF returns, retirement corpus & tax benefits for employees. How EPF Interest Rate Affects Monthly Salary & Retirement Corpus (2026 Guide) For salaried employees in India, EPF (Employees’ Provident Fund) is one of the most important long-term savings tools.

But many employees don’t understand how EPFO interest rate directly impacts salary, savings, and retirement corpus.

खूप लोकांना वाटतं PF म्हणजे फक्त deduction.

But actually, interest rate decides how powerful your PF becomes over time.

This article explains:

✅ What is EPFO interest rate

✅ How it affects monthly salary

✅ Long-term impact on retirement money

✅ Why even 0.5% change matters

EPF Interest Rate Impact on Salary 2026 What Is EPFO Interest Rate?

The EPFO interest rate is the annual return given on your EPF balance, declared every year by the Government of India.

- Applied on total PF balance

- Compounded annually

- Credited at end of financial year

👉 EPF interest is government-backed and relatively risk-free.

EPF Contribution Structure (Salary Impact):EPF Interest Rate Impact on Salary 2026

Monthly Salary Deduction Explained

| Component | Contribution |

|---|---|

| Employee Contribution | 12% of Basic + DA |

| Employer Contribution | 12% of Basic + DA |

| Total EPF Contribution | 24% |

👉 Interest rate does NOT change salary deduction, but it changes returns on that deduction.

Marathi Note:

Salary मधून किती PF कापला जातो ते fixed असतं, पण interest rate बदलल्यामुळे future value बदलते.

EPFO Interest Rate Impact on Salary 2026 – Example:

Example: Salary ₹40,000 (Basic ₹20,000)

- Employee PF: ₹2,400/month

- Employer PF: ₹2,400/month

- Total EPF: ₹4,800/month

- Annual Contribution: ₹57,600

Impact of Interest Rate Change (Long Term): EPF Interest Rate Impact on Salary 2026

| Interest Rate | Value After 20 Years |

|---|---|

| 8.0% | ₹26.4 lakh |

| 8.5% | ₹30.2 lakh |

| 9.0% | ₹34.8 lakh |

👉 Just 0.5% difference = lakhs of rupees more.

Why EPFO Interest Rate Is Important for Employees:

1️⃣ Retirement Corpus Growth

Higher interest rate =

✔ Bigger retirement fund

✔ Less dependence on pension or children

2️⃣ Guaranteed & Stable Returns

EPF is safer compared to:

❌ Equity market volatility

❌ Crypto or risky investments

Marathi Explanation:

Risk नको असेल तर PF हा best long-term option आहे.

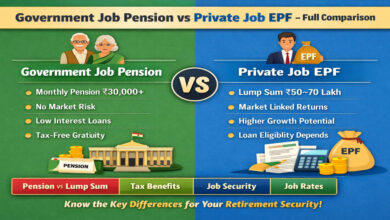

EPFO Interest Rate vs Other Salary Investments:

| Investment | Average Return | Risk |

|---|---|---|

| EPF | 8–8.5% | Very Low |

| PPF | 7–8% | Very Low |

| FD | 6–7% | Low |

| Equity MF | 11–13% | High |

👉 EPF = balance of safety + decent return

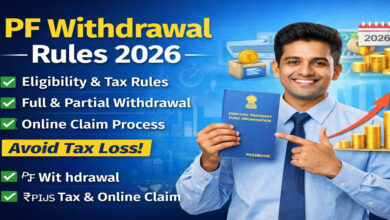

Tax Impact of EPFO Interest Rate:EPF Interest Rate Impact on Salary 2026

Tax-Free Benefits

- EPF interest is tax-free if:

- Annual contribution ≤ ₹2.5 lakh

- Service period ≥ 5 years

Taxable Scenario

- Interest on employee contribution above ₹2.5 lakh/year is taxable (as per rules)

Marathi Tip:

Majority salaried employees साठी EPF interest tax-free असतो.

EPFO Interest Rate & Government Employees:

- Most government employees are under NPS

- Old-scheme employees still enjoy EPF-like benefits

- EPFO interest rate is mainly relevant for:

- Private sector

- PSU employees

- Contract staff under EPF

Should You Depend Only on EPF?

❌ No (returns limited)

✅ Use EPF as foundation

Best strategy:

- EPF for safety

- Mutual funds for growth

- NPS for extra tax saving

Common Myths About EPFO Interest Rate:

❌ Interest rate changes salary – False

❌ EPF gives poor returns – False (risk-adjusted)

❌ PF money is locked forever – False

FAQs – EPF Interest Rate Impact on Salary 2026

Q1. Does EPFO interest rate affect my monthly salary?

No. Salary deduction remains same. Only returns change.

Q2. Is EPF interest better than FD?

Yes. EPF usually gives higher + tax-free returns.

Q3. Can EPFO interest rate go down?

Yes. It depends on market & government decision.

Q4. Is EPF interest guaranteed?

Yes. EPF is government-backed.

Q5. Should I increase voluntary PF (VPF)?

Yes, if you want safe, long-term, tax-efficient savings.

Internal Link:

Link with:

Final Summary:

The EPFO interest rate plays a crucial role in shaping your financial future.

Even though it doesn’t change your monthly salary, it decides how powerful your PF becomes.

✔ Stable

✔ Safe

✔ Long-term wealth creator

Understand it, respect it, and use it smartly.