Government Job Pension vs Private Job EPF 2026 – Full Comparison

Government Job Pension vs Private Job EPF 2026 Government pension or private job EPF? Compare pension amount, EPF interest rate, tax benefits, loans, insurance & retirement planning with examples. Choosing between a Government Job and a Private Job is not only about salary. The real financial difference comes from pension security, EPF returns, tax benefits, loans, and long-term stability.

This article gives a clear, neutral, money-focused comparison of Government Pension (OPS/NPS) vs Private Job EPF, explained in simple English + Marathi mix, with numbers, real-life examples, and FAQs people actually search.

What is Government Job Pension System? (OPS & NPS Explained) :Government Job Pension vs Private Job EPF 2026

Government employees in India are covered under two pension systems:

1️⃣ Old Pension Scheme (OPS)

- Applicable to some state governments

- Guaranteed pension = 50% of last basic salary

- No market risk

- Fully government-funded

👉 Marathi:

OPS madhe retirement nantar fixed pension milte, market var avlambun nahi. Salary jasti asel tar pension pan jasti.

2️⃣ National Pension System (NPS)

- Mandatory for Central Govt employees (joined after 2004)

- Employee contribution: 10% of Basic + DA

- Government contribution: 14%

- Market-linked returns (8–10% avg long-term)

👉 Marathi:

NPS hi investment-based pension ahe. Return market var depend karto, pan govt cha contribution jast aslyane risk thoda kami hoto.

What is EPF in Private Jobs? (Employee Provident Fund):Government Job Pension vs Private Job EPF 2026

EPF (Employees’ Provident Fund) is a retirement savings scheme for private-sector employees.

- Employee contribution: 12% of basic salary

- Employer contribution: 12%

- Current EPF interest rate: ~8.25% (Govt-declared)

- Lump-sum amount at retirement (not monthly pension)

👉 Marathi:

EPF madhe pension nahi, tar ek mothi rakam retirement la milte. Ti amount kasa vapraycha te employee var depend asta.

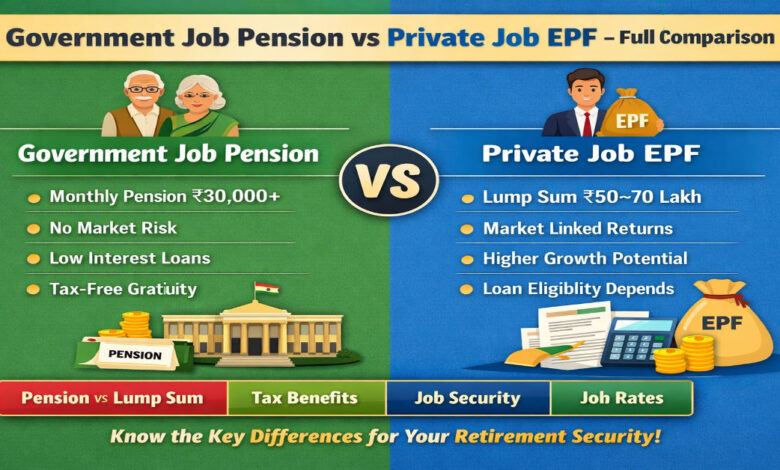

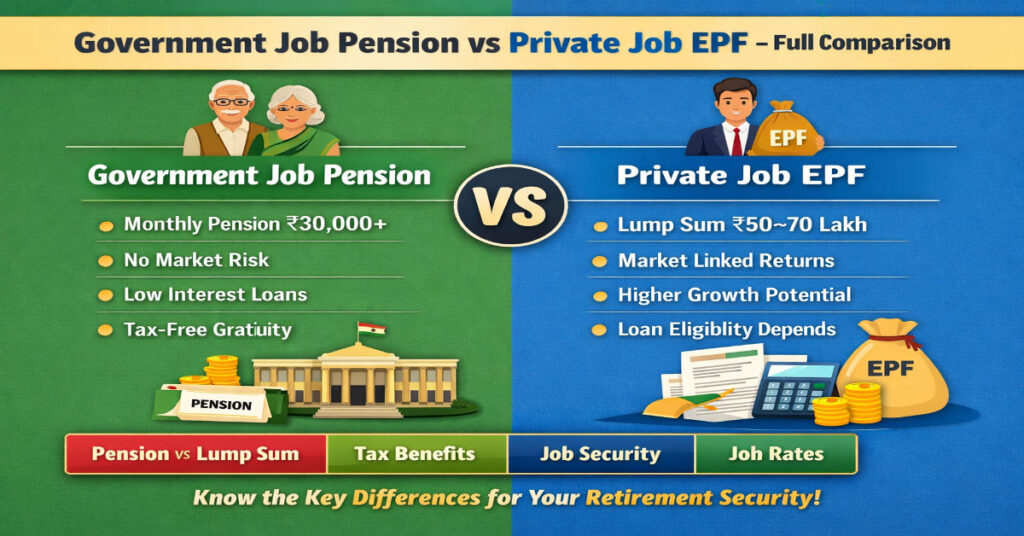

Government Pension vs EPF – Direct Comparison:

| Factor | Government Pension | Private Job EPF |

|---|---|---|

| Pension Type | Monthly Lifetime Pension | Lump Sum |

| Risk | Low / Govt-backed | Low–Medium |

| Market Dependency | OPS – No, NPS – Yes | Interest rate based |

| Inflation Protection | DA-linked | Limited |

| Tax Benefit | High | High |

| Job Security | Very High | Depends on company |

| Loan Eligibility | Strong | Moderate |

Monthly Pension vs Lump Sum – Real Example:

Example 1: Government Employee

- Last basic salary: ₹60,000

- Pension (OPS): ₹30,000/month + DA

- Lifetime income: ₹30,000 × 12 × 25 years = ₹90 lakh+

Example 2: Private Employee

- EPF corpus after 30 years: ₹50–70 lakh

- Monthly income depends on investment returns

👉 Marathi:

Government job madhe monthly cash flow fix asta, private job madhe self-discipline jaruri asta.

Loan Benefits: Government Job Pension vs Private Job EPF 2026:

Government Employee Loan Advantages

- Lower interest rates on:

- Home loan

- Personal loan

- Education loan

- Easy approval due to stable income

- Higher loan amount eligibility

👉 Marathi:

Bank la govt job mhanje low risk customer.

Private Job Loan Reality

- Interest rate depends on:

- Company profile

- Credit score

- Job stability

- Layoff risk affects eligibility

Tax Benefits Comparison:Government Job Pension vs Private Job EPF 2026

Government Employees

- NPS tax benefit:

- Section 80CCD(1): ₹1.5 lakh

- 80CCD(1B): Extra ₹50,000

- Gratuity & pension partially tax-free

Private Employees:

- EPF tax-free if:

- Service > 5 years

- ELSS, NPS optional for extra tax saving

👉 Marathi:

Tax saving sathi NPS + EPF combination private employees sathi best tharu shakta.

Insurance & Retirement Security:

| Aspect | Govt Job | Private Job |

|---|---|---|

| Health Insurance | CGHS / State Scheme | Employer-based |

| Post-Retirement Cover | Available | Mostly No |

| Family Pension | Yes | No |

Which is Better for Long-Term Wealth?

- Government Job:

- Best for risk-averse, family responsibility, stable life

- Private Job + EPF + Smart Investment:

- Best for high growth, business mindset, equity exposure

👉 Marathi:

Security pahije asel tar govt job, growth pahije asel tar private job + investment.

Frequently Asked Questions (Government Job Pension vs Private Job EPF 2026):

Q1. Is government pension better than EPF?

Yes for guaranteed monthly income, EPF is better for lump-sum wealth.

Q2. Can private employees get pension like govt job?

Not automatically. They must create pension via NPS, annuity, or mutual funds.

Q3. Is NPS risky compared to EPF?

Moderate risk, but long-term returns are usually higher.

Q4. Which is better for home loan approval?

Government job holders usually get lower interest rates.

Q5. Can EPF money be used before retirement?

Yes, for home purchase, medical, education, under rules.

Important Reference Links :

- National Pension System (NPS) – PFRDA

- Employees’ Provident Fund Organisation (EPFO)

- Income Tax Department – Tax Benefits

- RBI – Interest Rate & Loan Guidelines

(Use official government websites only for trust & EEAT)

Final Summary:

A Government Job offers financial certainty, pension security, and loan advantages, while a Private Job with EPF offers flexibility and higher growth potential if combined with smart investments.

There is no universal winner—the best choice depends on risk appetite, family responsibility, and long-term financial planning.

👉 Internal Linking Suggestion:

Link this article with:

- Best Government Jobs with Pension Benefits

- EPF Interest Rate Calculator

- NPS vs Mutual Fund Comparison